Recently, I remarked to a dear loved one about the price of groceries. After all, the cost of eggs, meat, dairy, etc has been a point of high political tension.

I expected the typical reply mentioning inflation or bird-flu. However, I was instead presented with a conjecture: the price was now high enough that eating out is often more affordable.

I retorted that this was surely impossible. After all, the common adage is that cooking at home is always cheaper.

Could it be that this advice has since gone stale? And can we blame Obama?

While I can’t help with the latter, the former is something we can solve.

Hypothesis

I believe, as I referenced in the previous conversation, that it is still much cheaper to purchase your food in the aisles rather than the menu.

Those who eat out for every meal will, on average, pay significantly more than those that cook for themselves.

Methodology

Instead of a simple Google search, let’s look at something more grounded: my own purchase history. Each month, I download and analyze my purchase history using Actual Budget (an open source finance tracker). I will use this data as the basis for my analysis.

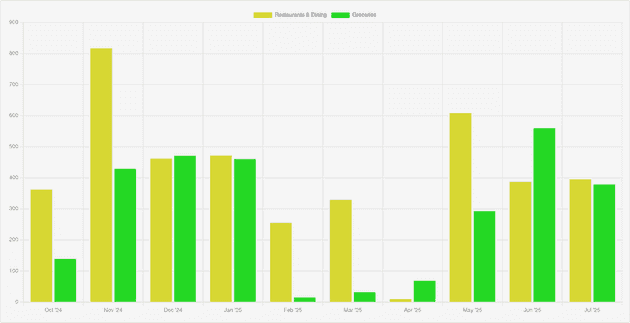

Above, we can see how much I spent on each category. You’ll notice that February, March and April all seem to be outliers to the general data. Avid readers will remember these anomalous months correlate to my recent ACL injury and subsequent surgery. During this time, I ate fewer meals and relied more on the generous cooking of others.

As such, we will be ignoring those months for the purpose of our analysis.

Finally, I use extrapolation to determine how much I would’ve spent if I only ate out or at in. This will involve determining the number of meals I ate per day, and then taking the per-transaction meal cost and extrapolating it to the estimated cost ()

Assumptions

As the aforementioned dear loved one, primary foe and audience for this blog post will contest, there are certain issues that will inevitable come up. Although I don’t have an exhaustive list, these are some of the more obvious ones:

- I don’t typically pay for every meal or grocery trip (my dear loved one will often split costs)

- I may skip meals or have more than 3 a day

- Some grocery transactions will have been made for certain hobbies (i.e. I recently canned several pounds of home-made pickles and jam)

- Some ”restaurant” purchases are actually coffee or small meals

I don’t believe any of the above will have a significant impact on my findings. First, though I often don’t pay for a meal, I will typically also pay for others. While paying for a meal for my dear loved one every now and then will impact my restaurant spending, I should also note that I equally pay for groceries for other individuals as well. In fact, I find myself purchasing plenty of snacks and food for others at the grocery store.

Additionally, though I may not always eat 3 times, this should average out over the many months in the data-set.

Next, the hobby purchases are only counted for grocery purchases. In my analysis, this will actually increase the grocery costs and thus reduce the apparent benefits of those purchases. Likewise, small restaurant purchases will consequently increase the attractiveness of that category by reducing the per-purchase cost.

For today, I believe it is a valid assumption to believe that grocery spending will be more negatively impacted by these issues than they could ever benefit.

Finally, I should also mention the high restaurant spending in November of 2024. Let’s just say it was a unique month.

Analysis

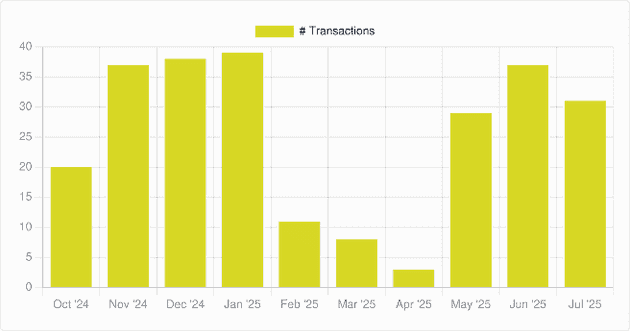

When we ask, which is cheaper, the real question is whether or not the per meal cost breaks down favorably. Above, I compare the total number transactions made per month. On average, I spent around $25.75 per transaction for restaurants. While I also paid $28.74 per transaction for groceries.

Of course, that does nothing to answer our principal question. Each grocery trip typically results in multiple meals, unlike a single-use restaurant transaction. Hypothetically, I could’ve converted a single grocery trip into many weeks of meals. We need a way to extrapolate how much I would’ve paid if I had substituted all restaurant purchases for home-made meals (and vice-versa).

For simplicity, I assume 3 meals per day over 30 days, or 90 meals per month. At one restaurant transaction to a meal, that would mean that the other meals in the month must be explained by my grocery purchases.

| Month | # Restaurant Transactions | # Grocery Transactions | # Estimated Total Meals | # Estimated Grocery Meals |

|---|---|---|---|---|

| Oct ‘24 | 15 | 5 | 90 | 75 |

| Nov ‘24 | 22 | 15 | 90 | 68 |

| Dec ‘24 | 22 | 16 | 90 | 68 |

| Jan ‘25 | 22 | 17 | 90 | 68 |

| May ‘25 | 21 | 8 | 90 | 69 |

| Jun ‘25 | 20 | 17 | 90 | 70 |

| Jul ‘25 | 14 | 17 | 90 | 76 |

| Total | 136 | 95 | 630 | 494 |

Over the course of these many months, I am estimating around 494 home-made meals to 136 meals purchased from a restaurant. Breaking this down with the actual cost:

| Month | # Restaurant Meals | Restaurant Spending | # Grocery Meals | Grocery Spending |

|---|---|---|---|---|

| Oct ‘24 | 15 | 362.24 | 75 | 138.87 |

| Nov ‘24 | 22 | 816.7 | 68 | 428.79 |

| Dec ‘24 | 22 | 461.55 | 68 | 470.98 |

| Jan ‘25 | 22 | 471.66 | 68 | 460.5 |

| May ‘25 | 21 | 608.27 | 69 | 292.48 |

| Jun ‘25 | 20 | 386.63 | 70 | 559.84 |

| Jul ‘25 | 14 | 395.28 | 76 | 378.76 |

| Total | 136 | $3502.33 | 494 | $2730.22 |

Using the above numbers, we get a much more accurate estimate for our per meal costs.

| Category | Per Meal Spending |

|---|---|

| Restaurant | $25.75 |

| Groceries | $5.53 |

At last, we see a far more striking difference in the data. Whereas before we saw a per transaction spending for groceries exceeding that for restaurants, we can correct for the week of leftovers from the typical home-cooked meal.

For fun, I also estimated how much it would’ve cost me to buy all

- 540 × $25.75 = $13,905.00 for restaurants

- 540 × $5.53 = $2,986.20 for groceries

Conclusion

Though it may not be entirely surprising to most readers, I believe this analysis was still fairly illuminating to me. As I predicted, eating out is way less affordable than eating in. Of course, this analysis may differ person to person. Large households vs single people may have different findings. However, what I didn’t expect from my analysis is the insane opportunity cost from eating out.

Had I eaten all my meals at home, I estimate I would have only needed to spend an additional $255.78 on groceries. During those 6 months, I spent over $3.5k on restaurants. This number is almost twice what the average American household spends. Of course, I often pay for other people’s plates. But, as I said before, I also tend to buy groceries for other people. This was fairly surprising none-the-less as I assumed I spent less in this category. I will need to better monitor my spending going forward.

Finally, I declare total victory over the argument. Even if we were to say half my estimated per meal restaurant spending, it would still be far better to visit the grocery store. I don’t blame them, or anyone, for feeling the effects of recent inflation. Though prices have clearly risen, it appears that the old adage remains strong.

I look forward to my dear loved one reading this.